Continuation standards: a guide for daytime traders in the cryptocurrency market

The cryptocurrency world is known for its volatility and unpredictability, making it a challenging market for traders. However, understanding of continuation standards can provide valuable information about price movements and help traders make informed decisions. In this article, we will explore what are the standards of continuation, how they work and some important strategies to incorporate them into your negotiating approach.

What are continuation patterns?

Continuation patterns refer to a specific type of technical analysis standard that appears when one trend is broken or rejected in favor of another. These patterns are often characterized by a “bent” or curved form, indicating that the price is trying to leave a previous resistance zone or support area.

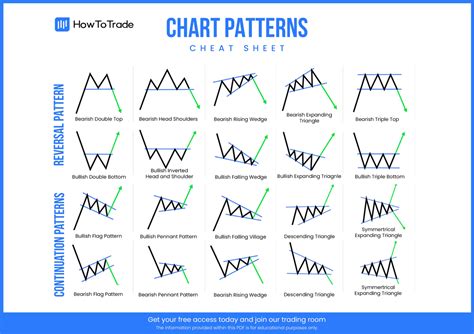

Types of continuation patterns

There are several types of continuation patterns, including:

- Head and shoulders : A classic pattern where high and low prices form a “head” and a “shoulder” respectively.

- Head and Inverse Shoulders : The reverse version of the head and shoulder pattern, where the “head” is above the “shoulder”.

- Cavulated standard

: a wavy or zigzag pattern that forms when the price breaks from an anterior resistance zone with increasing moment.

- Trend line rupture

: When a trend line is broken and new high prices form.

How to identify continuation patterns

To identify continuation patterns, you need to analyze various technical indicators, such as:

- Mobile Average (MAS) : The average price of currency in a specific period can help identify resistance and support trends and levels.

- Relative Strength Index (RSI) : RSI measures the magnitude of recent price changes to determine excessive or overwhelmed conditions.

- Bollinger Bands : These bands highlight volatility and provide an indication of market feeling.

Strategies -Chave to incorporate continuation patterns in your negotiation approach

After identifying a standard of continuation, here are some important strategies to incorporate it into your negotiation approach:

- Get profit : Define a profit level based on the point of interruption or when the price reaches a predetermined goal.

- Define a stop interval : Set a stop interval at a specific price level to limit potential losses if the trend reverses.

- Commercial Continuation : Use continuation patterns as a trigger to insert new negotiations, such as buying or selling coins based on a specific standard.

Example of a continuation pattern in action

Let’s consider an example in which we identify the reverse pattern of the head and shoulders in Bitcoin (BTC/USD) at $ 28,000. We realize that the price is forming a “head” above the previous resistance level ($ 29,500), followed by a “shoulder” below it ($ 27,800). However, if we get out of this pattern, we can take advantage of the growing moment and enter a long position.

Conclusion

Continued standards are an essential tool for daytime traders to obtain information about price movements in the cryptocurrency market. By understanding these standards and incorporating them into your negotiating approach, you can make more informed decisions and increase your chances of success. Remember to always use risk management techniques and remain disciplined when you go into negotiations.

Additional resources

For additional learning, here are some recommended resources:

* Cryptoslate : A website dedicated to cryptocurrency news, analysis and insights.

* CONDESK : An on -line publication in cryptocurrency news and trends.

* TradingView : A platform that offers real -time graphics, technical indicators and negotiation ideas.